Congressional Perks: Luxury cars and mileage result in big costs for taxpayers

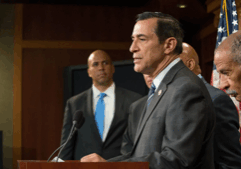

U.S. Reps Darrell Issa, R-Calif., and David Scott, D-Ga., have each had taxpayers pay as much as $1,000 every month to Lexus financial so they can lease a vehicle for their offices, a review of House Members’ Representational Allowance records by The Center Square found.

Before he left Congress in 2023, longtime Illinois Democrat, U.S. Rep. Bobby Rush, was also spending $999 monthly to lease a Lexus, records show.

They are just three of about a dozen of members who spend the max of $1,000 – or nearly the max – allowed by the House members handbook to lease luxury vehicles for their offices.

Since 2019, taxpayers paid $3.5 million for automobile leases out of the MRA accounts, including to top luxury auto makers like Lexus, Volvo and Tesla along with less expensive leases for Ford, General Motors, Hyundai and Honda.

And when they weren’t leasing pricey vehicles, some lawmakers and staff put in for massive mileage reimbursements, MRA records show.

U.S. Rep. Kevin Hern, R-Okla., had taxpayer pay him $131,000 for personal car mileage since 2019, according to the data.

Hern spokeswoman Ashley Haines defended the reimbursements in an email to The Center Square.

“Every Member of Congress is eligible to receive reimbursement for mileage when conducting official business, including traveling between their districts and Washington, D.C.,” she wrote. “Rep Hern’s mileage reimbursement submissions have followed all House rules and guidelines and is a reflection of his commitment to meeting directly with Oklahomans and ensuring they’re represented in Washington.”

Longtime House staffer John Etue, who recently was hired by U.S. Sen. Ted Cruz, R-Texas, as his chief of staff, filed $130,000 in mileage reimbursements since 2019, when he worked in the House, an analysis of MRA data by The Center Square shows. He did not respond to messages left at Cruz’s office.

Sam Denham, a spokesman for U.S. Rep. Roger Williams where Etue worked before Cruz, sent a statement justifying the mileage reimbursements.

“The district Congressman Williams represents spans 13 counties across hundreds of miles of Texas, and our staff provides constituent services to every one of our constituents, often requiring long drives and many miles of commuting to be on the ground where called,” he wrote. “For the 13 years our constituents have entrusted us to serve them, we’ve held true to our commitment to meet them where they are.”

Considering the earth circumference is nearly 25,000, each of those reimbursements were for enough miles that Etue and Hern could have circled the globe about eight times if there was a road along the equator.

Former U.S. Rep. Adam Kinzinger, an Illinois Republican who left Congress in 2023, filed for $95,000 in what was listed as private auto mileage reimbursements between 2019 and his retirement, including the largest single reimbursement of any member or staff on July 14, 2022, for $8,697.05, The Center Square analysis of data found.

Kinzinger told The Center Square that he wasn’t sure why his reimbursements were listed as private auto mileage because he was being reimbursed for flying his personal plane from Rockford, Ill., to D.C. and on other business-related trips.

“The reason I decided to fly myself is I had significant security concerns after Jan. 6,” he said in a phone interview.

Data shows Kinzinger reimbursed himself about $30,000 before Jan. 6, 2021, ranging from more than $2,700 to less than $14.

He conceded he had taxpayers reimburse the use of his private plane before the Jan. 6 controversy when he took a strong position denouncing the sometimes violent protest at the U.S. Capitol and joining the committee that investigated the incident.

When asked whether it was appropriate to have taxpayers pay for his private plane at a rate about three times the amount for private car mileage and more expensive than commercial flights, Kinzinger said he followed the rules but did not know why staff submitted as private auto mileage.

Experts question spending

David Williams, president of the Taxpayers Protection Alliance, said the spending found by The Center Square is an abuse of taxpayer resources and should be stopped.

“It’s outrageous that they would spend, you know, $1,000 a month on a lease, and especially if they’re leasing luxury cars,” he said. “We’re talking about a group of people who are driven around in the city, like, I mean, they have a staffer drive them to events.”

As for the massive mileage, Williams scoffed: “It almost begs for a CFO of Congress to look at the individual expenditures, and because apparently no one is watching right now, there’s no oversight on this, and when you’re spending more than $100,000 on mileage, I mean, … that’s got to be a red flag, but there’s no one there to see that red flag and to investigate so they’re taking advantage of a broken system, and until the system is repaired in any way, they’re going to continue to do so, because there’s no repercussions.”

Private auto mileage reimbursements for all members and staff cost taxpayers $30.1 million since 2019, the data shows.

JD Rackey, associate director of the Structural Democracy Project at the Bipartisan Policy Center, who defended much of the spending The Center Square exposed for this series, had trouble justifying the mileage and luxury leases.

“I can’t say whether there should or shouldn’t be a certain policy,” he said. “I think that there are probably a lot of members who would be open to … adopting such a standard (to limit the types and cost of vehicles leased).”

Rackey said there used to be more oversight from administrative committee staff and if members and staff are called out on questionable spending there will be more again.

“I think there are certainly things that can be done to improve the efficacy of these reimbursements, and things like updating how disbursements are released so that they’re machine readable and user friendly,” he added. “Right now, it’s set up that members are the final say on, you know, all reimbursements and expenses from their office.”

The House Committee on Ethics, which investigates allegations of abuses of MRA, informs members on their website that: “Federal law provides that official funds may be used only for the purposes for which they are appropriated. When funds are used other than for their intended purposes, the misused funds may be recovered by the government…” It also warns that submitting “a voucher for other than official expenses may involve a fraud against the government, in violation of 18 U.S.C. 1001.”

Tom Rust, staff director of the House ethics committee, emailed “no comment” in response to an inquiry from The Center Square about whether the committee has investigated any mileage reimbursements detailed in the data. Taxpayers pay Rust $206,100 in salary last year, according to Legistorm.

Scott and Issa, who is one of the wealthiest members of Congress with a personal net worth of nearly $300 million, did not return calls and emails to their staff seeking comment. Rush couldn’t be reached for comment with no working phone numbers available in public records data.

Latest News Stories

Illinois, Chicago residents rank high taxes as state’s top issue

Illinois quick hits: Illinois House members vote along party lines; More than 40% of CPS teachers missed 10 or more school days; State Treasurer says Bright Start earns gold

New Lenox Solar Farm Gains County Committee Approval with Conditions

Committee Approves Frankfort Township Gaming Bar on Split Vote

Crete Township Senior Group Home Gets Unanimous Committee Support

Beecher-Area Rezoning and Variances Approved to Legalize Structure

Committee Approves Wilton Township Land Division Despite Spot Zoning Concerns

Meeting Summary and Briefs: New Lenox Village Board for October 27, 2025

Meeting Summary and Briefs: Will County Capital Improvements & IT Committee for November 4, 2025

New Lenox Announces 5.51% Increase in 2025 Property Tax Levy

Glock: Judge’s OK of Chicago’s anti-gun lawsuit questionable, at best

Illinois quick hits: DHS responds to migrant release order