Expert: Arizona’s 2026 budget faces Big Beautiful Bill impact

The biggest impact on Arizona’s 2026 budget will come from the federal One Big Beautiful Bill Act, according to Glenn Farley, the Common Sense Institute’s director of policy and research.

CSI released a report earlier in October detailing issues the Legislature will need to address next year.

Congress passed the One Big Beautiful Bill Act in July, which made numerous changes, including minimizing taxes and reducing the cost of federal programs.

Farley, who authored the CSI report, told The Center Square the federal government changed its rules concerning Medicaid and the Supplemental Nutrition Assistance Program, formerly known as food stamps.

Farley said the federal government is attempting to “get its budget under control” and has identified waste and abuse in Medicaid and SNAP.

The One Big Beautiful Bill Act includes provisions to limit the growth of costs and improve how states administer the programs, Farley said.

Farley noted the federal government changed who is eligible for Medicaid, how people remain eligible for Medicaid and how states pay for the program.

All three changes will affect how Arizona implements its Medicaid program, he said.

Arizona’s general fund will not be affected much by these changes, Farley noted. He added the changes will mostly affect the state’s hospital assessment funds, which are taxes paid by hospitals that rely on Medicaid. The taxes help Arizona cover Medicaid costs.

“ The reason Medicaid providers are OK paying these taxes is that money is then used to fund expansions to the state’s Medicaid program,” he explained.

Farley said Arizona has seen an increase in its hospital assessment funds since the COVID-19 pandemic. In the One Big Beautiful Bill Act, the federal government capped these funds at 6% and is phasing them down to 3.5%, the policy director explained.

The phase-down will affect Arizona’s Medicaid program because federally funded payments to Medicaid providers will decrease, Farley said.

The work requirement is intended to examine noncitizen enrollment in state Medicaid programs, Farley said. He added that this rule won’t significantly affect states, except by reducing the size of their Medicaid programs.

Farley noted SNAP is federally funded but state-administered.

The federal government has adjusted the requirements for states to “control and limit payment error rates,” which the policy director said shows how “accurately” a state distributes its benefits within the state.

If Arizona does not get this under control, then it will not be a fully federal government-funded program, but rather a cost-sharing program, which “would be a general fund exposure,” Farley said.

Arizona could end up paying up to 15% of the program, he added.

“The higher a state’s error rates, the higher the cost-sharing percentage,” Farley said.

The economist said states with the highest payment error rates were Alaska and Maryland, while the lowest were South Dakota and Idaho.

Farley said Arizona is on the high end of states in its payment errors, but not nearly as high as Alaska. He estimated Arizona’s cost-sharing estimate is around 10%. If a state can reduce its error rate below 6%, there will be no penalty, he explained.

Before the COVID-19 pandemic, Arizona was running at an error rate of 6%, Farley said.

The policy director predicted if Arizona can’t rein in its error rates “quickly,” then it could cost the state between $150 million and $200 million from its general fund in fiscal year 2028.

According to Farley, the federal government’s changes to the SNAP program will have a greater impact on Arizona’s general fund than the Medicaid changes.

The CSI report noted Arizona’s general fund had increased by 44% over the last 10 years. The budget went from $32.8 billion in fiscal year 2015 to $66.2 billion in fiscal year 2025.

An item that may further increase Arizona’s general fund expenditures is Proposition 123, which expires next year.

Farley explained that the proposition shifted some of Arizona’s K-12 funding from the general fund to its land trust. When the proposition expires, those costs will be moved back to the general fund, impacting it between $200 million and $300 million, he said. An extension of the proposition would alleviate this impact, the policy director said.

Arizona is projected to spend over $10 billion on education this year, with almost 70% of that going to public schools, according to the Common Sense Institute report.

Looking ahead, Farley said Arizona is in a “strong position to iron out” its financial issues.

In June, Arizona passed a $17.6 billion budget. Democratic Gov. Katie Hobbs signed the budget just days before a shutdown. Her approval came after negotiations with legislators and her vetoes of two previous budgets approved by the Republican-controlled Legislature.

Heading into next year, Senate President Warren Petersen, R-Gilbert, told The Center Square that the Legislature is “focused on prioritizing essential services, rooting out waste and holding the line on new spending.”

“Our goal is to make sure every taxpayer dollar is used efficiently, and that government lives within its means,” he said.

Petersen said he has already had “early conversations” with his “House counterparts and fiscal experts to identify challenges ahead of time.”

“The more we front-load that work, the less room there is for 11th-hour surprises. My focus is on transparency, predictability and responsible budgeting that protects taxpayers,” the senator noted.

Latest News Stories

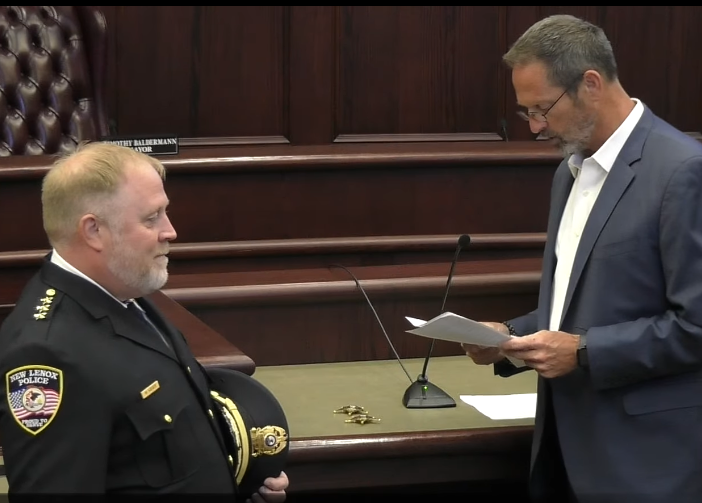

New Lenox Swears In New Police Chief Micah Nuesse, Deputy Chief Brandon Tilton

Public education budgets balloon while enrollment, proficiency, standards drop

Meeting Summary and Briefs: Will County Board Executive Committee for August 14, 2025

New Lenox Fire District Approves Contract for $4 Million Station 62 Remodel

New Lenox to Reinstate 1% Grocery Tax, Mayor Blames State Politics

New Lenox Township Receives Clean Audit, Praised for Fiscal Strength

Frankfort Approves Over $19 Million in Surplus Fund Transfers for Future Projects

Frankfort Advances Plans for New Multi-Use Paths to Boost Pedestrian Safety

Frankfort Police Department to Purchase New Portable Radios for $31,000

Meeting Summary and Briefs: Village of Frankfort Board for August 18, 2025

Executive Committee Details Spending of $134 Million in Pandemic Relief Funds

Report: Human Rights Campaign pressures transgender procedures on minors